As you’re reading this you might be unaware that somewhere near you right now is a piece of equipment operating thanks to a semiconductor, or chip. It’s there in your smartphone, perhaps in your washing machine, certainly your laptop and bluetooth headphones. Thousands of everyday products rely on semiconductors and, as we said in a blogpost last year1, the tech intensity of GDP will continue to increase. At the heart of this is the chip industry – so not only is it a growth industry, it is also quality.

As such we are very interested in companies operating within this area, and TSMC (Taiwan Semiconductor Manufacturing Company) is a very good example2. TSMC, established 35 years ago, was the first dedicated semiconductor foundry, allowing chipset designers to outsource the manufacturing process. It is now the world’s largest semiconductor foundry with a 55% market share3. It has achieved this position through excellent manufacturing standards at both established and cutting-edge technology nodes.

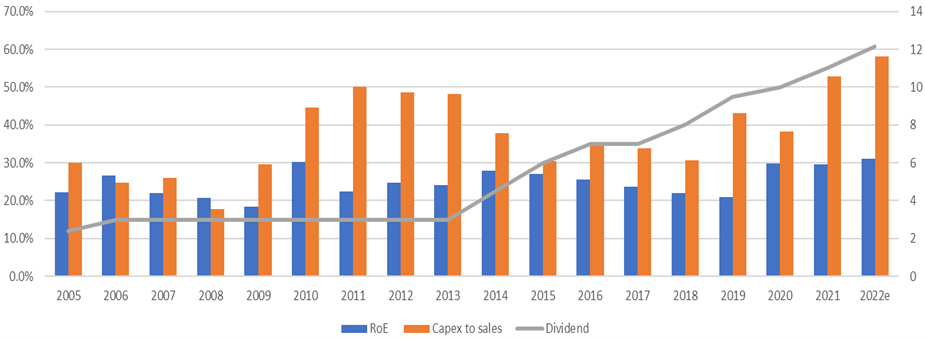

With the advent of 5G and the increased use of AI driving a marked increase in computational power, TSMC chose to spend $30 billion in capex in 2021 and expects to spend an all-time high of $42 billion in 20224 in order to drive growth higher still (Figure 1).

Figure 1: On the up – TSMC’s investment, returns and dividends (2005-2022)

This investment in growth doesn’t appear to be at the expense of good returns, however. Analysis suggests the capex-to-sales ratio will climb to almost 60% during this investment phase before returning to the mid-30s. This has led TSMC to raise its long-term revenue growth rate range by 5% to 15%-20%.5 However, the long-term return-on-equity target has also been raised from 20% to 25%. It is able to do this due to a combination of factors: TSMC saw $6.7 billion of pre-payments from customers in 2021 and is receiving subsidies from governments which helps finance the investment. Additionally, it has raised its long-term gross margin target from 50%+ to 53%+ as it takes greater market share and exerts pricing power, which is something it has previously been unwilling to do.6

Capital return to shareholders has grown rapidly since its last large investment phase almost a decade ago, with the dividend increasing by 367% over the past 10 years or a 14% compound annual growth rate (CAGR).7 This will likely slow during the investment phase before accelerating once again when capex falls.

We applaud this approach to capital allocation, which carefully balances market position, growth and returns on equity and to shareholders. TSMC has capitalised on its first mover advantage as a dedicated semiconductor foundry and is now aiming to extend this leadership.