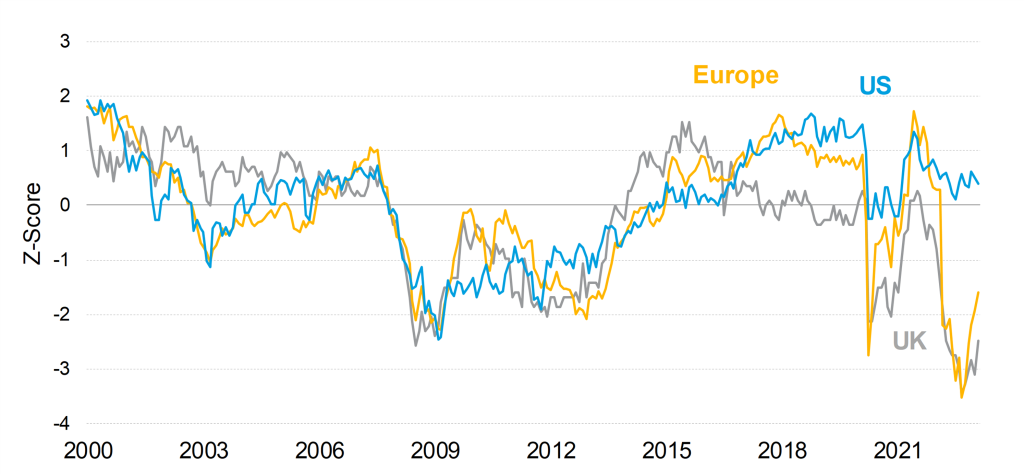

Aggressive monetary tightening is having an impact.

The background to recent events is very aggressive interest rate hikes – we haven’t seen this degree of rapid monetary tightening for decades. We also need to add in the additional impact of the shift from quantitative easing to quantitative tightening.

US rates have risen fastest and furthest. We see clear signs that this has produced a credit squeeze. It has also exposed a gap in US regulation of second tier banks, that allowed SVB to take an extraordinary duration-risk position, and issues over the widespread usage of money market funds in the US. By contrast we believe that Credit Suisse is a single, special case, not something generic around European banks.

We think the credit squeeze is much more significant in the US. By contrast Europe is getting a timely boost from falling energy prices. The current theme is therefore there improving news flow in Europe and declining news flow in the US.

Central banks raise rates aggressively

Source: Columbia Threadneedle Investments and Bloomberg as at 28 February 2023

US credit squeeze brings recession closer.

US banks had already tightened lending standards sharply, to levels approaching those seen in the Global Financial Crisis, before the collapse of SVB. We can also see signs of a credit tightening in the US corporate bond market.

US consumers have remained positive and have been rapidly spending their ‘Covid piggy-banks’. The scale of their spending has been enough to postpone any recession until now.

There are some encouraging signs of US inflation already falling, even in the crucial areas of accommodation and wages. However, we think that there needs to be clearer signs of a loosening employment market and that likely requires a recession and rising unemployment before the Fed reverses course.

We don’t think the forecast recession is going to be that bad in the US.

Banks already tightening lending standards

Source: US federal Reserve, European Central Bank, Bloomberg as at 28 February 2023. Data measures % of banks tightening lending standards minus those loosening and therefore range between +/ -200%

Pessimism in Europe remains excessive despite the passing of the energy crisis.

Worries about financial contagion seem just another symptom of an extraordinary collapse of confidence amongst businesses, investors and especially consumers in Europe over the past year. Consensus forecasts are still for a recession despite the passing of the energy crisis.

I’m not forecasting a boom in Europe, however, falling energy prices should bolster growth and, more importantly, confidence. Once confidence returns there should be a virtuous circle which should be enough to sustain economic growth.

There has already been a significant improvement in business confidence. European consumer confidence has also rallied, but the starting point was more depressed than during the Global Financial Crisis or Covid. But once the once the fears over whether they can cover their winter energy bills dissipate, European consumers still have their ‘Covid piggy-banks’ to spend. I see a big turnround coming in German retail sales.

While a warm, wet and windy winter was key, the avoidance of the energy crisis was not just luck. There was a massive supply and demand response. The well-designed German intervention in energy markets stands out, protecting consumers while energy consumption was also cut significantly, beating 20% reduction targets.

Consumers in Europe less depressed

Source: Columbia Threadneedle and Bloomberg as at 28 February 2023.

UK is also too gloomy, though the higher mortgage rate caps enthusiasm.

In the dark days of autumn, the implied probability of UK recession reached 91%, an unheard of degree of agreement amongst economists!

Not only has the energy crisis now passed, but energy prices for next winter have fallen rapidly in the last few months. We expect a fixed-price retail offer below the £2,500 cap for next winter to be available soon. That should remove a significant fear for UK consumers.

While the market is sceptical, we believe the 2.9% target for inflation at the end of this year, set by government and now backed by the Bank of England, is entirely reasonable. Energy bills will see a 90% hike replaced with a 20% cut and impact on the inflation figures will be dramatic.

Before we get carried away, the big increase in mortgage rates will be a very significant drag on the UK economy. However, the impact will be spread over coming years by the remaining terms of fixed-rate mortgages. The UK economy is set to grow, but modestly.

Rising mortgage rates a major headwind for UK economy

Source: Columbia Threadneedle and Bloomberg as at 28 February 2023.

Government bonds offer value, as do UK and European risk assets

Given the real yields on offer, government bonds appear attractive. While interest rates may continue to rise, this highlights the determination of central banks to bring inflation under control.

There is a realistic possibility that US rates drop below those in Europe, especially as the latter have further to rise. That would point to euro appreciation and US dollar weakness.

US corporate profit margins have already come under pressure even as volume growth has been strong. By contrast there is a more positive picture for profitability at European and UK companies. This is goes alongside a less attractive outlook for the key US tech sector, as mature technology companies increasingly compete over their markets. We therefore prefer European and UK risk assets.

China has gone from Covid zero to Covid-100. The re-opening of their economy is a big boost to the global economy.

Enormous changes in 10 years real rates

Source: Columbia Threadneedle and Bloomberg as at 28 February 2023.