There’s only one way to summarise Q2:

a world divided. In North America and

Europe economic recovery exceeded

expectations as successful vaccination

programmes supported market

reopening. Here in the UK we emerged

from a bleak winter of strict lockdown

desperate to spend our savings and enjoy

life again. And it’s this pent-up consumer

demand that has helped drive robust

economic recovery in those economies

that have once again opened up.

Employment, too, is quickly on the road

to recovery.

However, the rise of the Covid-19

Delta variant in Asia has led to renewed

lockdowns in this region, either because

vaccine rollouts have been slow – as is

the case in Japan – and/or governments

are still committed to zero-Covid tolerance

policies. This has renewed pressure on

economies there and led to Asian markets

lagging both Europe and North America.

The inflation debate continued to rage

over the quarter, too, as global shortages

showed little sign of abating. In fact, the

fresh Covid wave in Asia and ensuing

lockdowns only further exasperated supply

chain disruptions leading to input cost

and price hikes. This has created some

extreme anomalies in global markets, for

example in the US used car prices for

several models are now higher than their

new car equivalents!

But unlike in Q1, the market has

taken a more pessimistic economic

view – fuelled by the rise of the Delta

variant – that these strong demand trends

will fade into year end and that high

inflation is temporary. This resulted in the

US 10-year bond yield retracing its lows

and a subsequent rotation back into

quality stocks which helped the strategy increase 8.4% over the quarter,

outperforming the MSCI ACWI benchmark

by 0.9%.1

Positively over the quarter, two of our

companies2 held capital market days

and spoke of accelerated sustainable

investments:

- SGS, a testing, inspection and certification services company, laid out its vision for 2023 with a focus on the mega trends driving additional demand for its services. As a result, sustainability is increasingly feeding into its business alignment. Beyond 2023, SGS aims to generate more than 50% of its revenues from sustainability solutions, versus 45% in 2020, with a clear focus to grow both health and nutrition and environmental services. This in turn will help its customers become more ESG compliant.3 SGS, a testing, inspection and certification services company, laid out its vision for 2023 with a focus on the mega trends driving additional demand for its services. As a result, sustainability is increasingly feeding into its business alignment. Beyond 2023, SGS aims to generate more than 50% of its revenues from sustainability solutions, versus 45% in 2020, with a clear focus to grow both health and nutrition and environmental services. This in turn will help its customers become more ESG compliant.3

- Orsted, the world’s largest offshore wind farm developer and operator, introduced a target of 50GW of installed renewable capacity by 2030, significantly ahead of its previous target of 30GW set in 2018 and against its current 12GW installed capacity. This signals its high confidence in its ability to win renewable contracts over the next decade.4

Engagement highlights:

The Global RI Team attended the

Exane ESG conference5 where the

overriding message was that sustainability

is increasingly a key driver of customer

demand for products and solutions.

We met with the management teams of

several of our holdings, including:

- Croda, a specialty chemicals company which commented that it is in a strong position to gain share in all segments given its focus on sustainable outcomes. In its personal care segment, for example, it is seeing key customers such as L’Oreal, increasingly focus on clean and green ingredients in their beauty products. Croda’s aim is that by focusing on sustainability in all its product innovation and investment it can help reduce the environmental impact of consumers through the products they consume, as well positioning the company on the right side of environmental legislation.

- Sika, a leading construction chemicals and products company, noted that the sustainability element in buildings and construction is growing. It expects sustainability in construction will become even more dominant over time as government environmental legislation and customer sustainability demands increase.

- Schneider Electric, which provides energy management and industrial automation solutions, also noted an increased sustainability focus across governments, customers and investors. It is seeing ever higher levels of stimulus packages in the EU and the US focused on energy transition, smart infrastructure and industry digitisation supporting structural demand for its sustainable solutions.

1Columbia Threadneedle Investments, June 2021.

2 Mention of specific stocks should not be taken as a recommendation to buy

3 SGS, Sustainability Ambitions 2030, July 2021.

4Orsted, Realising our full potential as a global green energy major, June 2021.

5 Exane BNP Paribas, 23rd European CEO Conference, 3 June 2021.

2 Mention of specific stocks should not be taken as a recommendation to buy

3 SGS, Sustainability Ambitions 2030, July 2021.

4Orsted, Realising our full potential as a global green energy major, June 2021.

5 Exane BNP Paribas, 23rd European CEO Conference, 3 June 2021.

Germany was one of a number of countries around the world to experience extreme weather conditions this summer. Source: iStock.

Sustainable Theme Focus: The climate crisis becomes real

As I watched monsoon winds and rain lash our campsite over our summer break, flooding

tents and fields, it is hard to deny that climate change is real, writes Pauline Grange. Part of

climate change means more intense rains as well as more intense droughts – and we have

seen both around the world in recent months.

The volume of extreme weather so far

this year has been exceptional by any

standards, from the record-breaking

heatwave in Canada, which saw

temperatures reach a record 49.6 degrees

centigrade,1 to the disastrous floods in

Europe’s Rhineland2 and China’s Henan

Province3 to the huge wildfires raging

from Siberia4 to California5 to Turkey6 and

Greece.7 Images across media of destroyed

bridges, roads and houses show the

physical consequences of climate change.

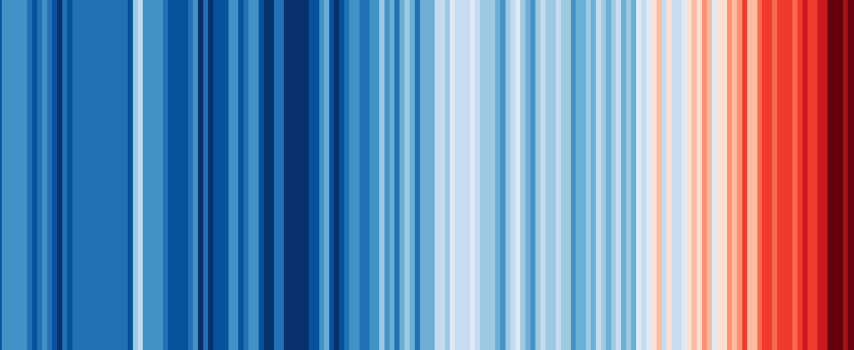

We are now at around 1.1oC warming,

but are on track for temperatures to go

much higher. Figure 1 clearly illustrates just

how much the earth’s climate system has

warmed since the pre-industrial period. It

is hard not to agree with Greta Thunberg’s

tweet: “We’re at the very beginning of a

climate and ecological emergency, and

extreme weather events will only become

more and more frequent”.8

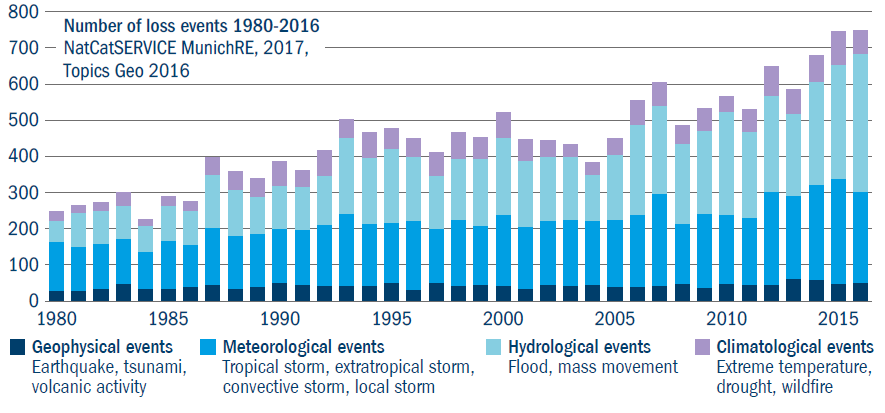

We are also seeing the effects of these

increasing numbers of extreme events

(Figure 2) in financial markets. For example,

coffee prices have surged to levels not

seen since 20149 after Brazil’s worst frost

in two decades, coupled with droughts,

impacted crop yields.

The heat waves and

droughts on both sides of the US-Canada

border this summer are also expected to

hit crop yields, and flooding in China’s key pork producing region has increased the

risk of animal disease. Meanwhile, the

Texas freeze earlier this year cost some

utility companies millions.10

Figure 1: Global average temperatures, 1850-2020

Source: https://showyourstripes.info/ Each stripe is one year, blue stripes are cooler years, red stripes are warmer years.

Figure 2: Increasing extremes

Source: https://www.metoffice.gov.uk/weather/climate/climate-and-extreme-weather

We now know that immediate and

large-scale reductions in greenhouse gas

(GHG) emissions are vital if we are to limit

warming to less than two degrees – and

it looks like the world is finally starting to

wake up to this climate change emergency.

In May, the IEA (International Energy

Agency) released a report detailing the

pathway to a net zero energy system

by 2050.11 Net zero means an overall

balance between emissions produced

and emissions removed from the earth’s

atmosphere. The IEA’s key finding is that

this transition requires an unprecedented

transformation of how energy is both

produced and consumed globally.

This in turn requires the immediate and massive deployment of all available clean

and efficient energy technologies as well

as a co-ordinated global push to

accelerate innovation in new technologies

such as advanced batteries, green

hydrogen and carbon capture and storage.

Another stark conclusion is that no new

oil and gas developments are needed to

meet our future energy needs, and in fact

there should be no new investments in

fossil fuels starting this year if we are

to achieve net zero.

It shouldn’t come as a surprise, then,

that climate change pressure on oil and

gas companies is starting to build, not just

from regulatory bodies but also investors

and customers. In fact, there were some

key investor milestones that coincided

with the release of this IEA report:

- In the Netherlands a court ordered Shell to deepen its carbon emissions cuts by at least 45% by 2030 (versus a current 20%) compared to 2019 levels.12

- In the US, Exxon has notoriously lagged its European peers in its decarbonisation agenda. But in a surprise move, two members of the activist investor Engine No. 1, which only has a 0.02% stake, had two candidates with climate expertise elected to Exxon’s board of directors, with the public backing of other major investors.13

- At Chevron, meanwhile, investors passed a resolution in favour of cutting Scope 3 emissions, ie the emissions created by customers of Chevron’s products.14

The message is clear: if the autos

and utilities sectors can successfully

implement “green” transition plans, there

is no reason oil and gas companies cannot

do the same, with investor and government

pressure on these companies starting to

build both in Europe and in the US.

Although the rise of net zero targets

has been remarkable over the past 18

months, with pledges from jurisdictions

now covering 70% of global GDP,15 very

little has so far translated into actionable

plans. In fact, fewer than a quarter of these

net zero pledges have been fixed into

actual legislation or policy.

But in a positive step, Europe has

started to put its net zero targets into

action by unveiling its long-awaited “Fit for

55” package.16 This package, if passed,

aims to align Europe’s various climate

policies with its 55% carbon reduction by

2030 goal and in turn makes its existing

climate policies both more rigorous and

broader in scope.

One of the biggest policy changes is

the expansion of the EU carbon emissions

trading scheme (ETS). Climate change

policy over the past 10 years has largely

been focused on decarbonising the

power sector, with other industries largely

untouched. But this package seeks to

change that as Europe expands the ETS to all carbon emitting industries,

including transportation and buildings.

Europe is committed to making carbon

prices more reflective of the cost of

decarbonising its economies with the

aim being that as the carbon price rises,

corporates will better incorporate climate

factors into their investment decisions.

The package also introduces a new

carbon border tax, increased support for

sustainable fuels, greater growth prospects

for renewables, a push in the acceleration

of electric vehicles and renovating

buildings to be more energy efficient.

It will also see the introduction of more

stringent fossil fuel taxation.

We believe we are only at the

beginning of this decarbonisation mega

theme. Political will to tighten emission

targets will only rise from here as climate

change accelerates.

The Threadneedle Sustainable

Outcomes Global Equity strategy is

well positioned to benefit from these

changes.

We are invested in leading

renewable companies which will benefit

not only from the expected acceleration

in renewable investment over the next

decade, but also from greater demand for

electricity as we electrify our economies.

We are also invested in those companies

offering “green” solutions across mobility,

buildings, industries and agriculture.

We believe our focus on positive

sustainable outcomes places this

strategy in a strong position to deliver

solid returns for investors over the next

decade as we sit on the right side of both

environmental customer demand trends

and government regulation.

1https://www.bbc.co.uk/news/world-us-canada-57654133,

30 June 2021.

2 https://www.bbc.co.uk/news/world-europe-57850504,

15 July 2021.

3 https://www.theguardian.com/weather/video/2021/jul/22/

henan-floods-aerial-images-show-flood-devastation-in-chineseprovince-

video, 22 july 2021.

4https://www.theguardian.com/world/2021/aug/09/smokesiberia-

wildfires-reaches-north-pole-historic-first,

9 August 2021.

5 https://www.theguardian.com/us-news/2021/aug/17/ california-wildfires-dixie-fire-damage-crews, 17 August 2021.

6 https://www.bbc.co.uk/news/world-europe-58057081, 2 August 2021.

7 https://www.bbc.co.uk/news/world-europe-58141336, 9 August 2021.

8 https://twitter.com/GretaThunberg/ status/1415600846356819971?s=20, 15 July 2021.

9 https://www.ico.org/show_news.asp?id=761

10 https://www.wsj.com/articles/texas-grapples-with-crushingpower- bills-after-freeze-11614095953

11 https://www.iea.org/reports/net-zero-by-2050

12https://www.bbc.co.uk/news/world-europe-57257982

13https://www.reuters.com/business/sustainable-business/ shareholder-activism-reaches-milestone-exxon-board-votenears- end-2021-05-26/

14https://www.reuters.com/business/energy/chevronshareholders- approve-proposal-cut-customeremissions- 2021-05-26/

15Energy & Climate Intelligence Unit, TAKING STOCK: A global assessment of net zero targets, March 2021.

16https://ec.europa.eu/commission/presscorner/detail/en/ ip_21_3541

5 https://www.theguardian.com/us-news/2021/aug/17/ california-wildfires-dixie-fire-damage-crews, 17 August 2021.

6 https://www.bbc.co.uk/news/world-europe-58057081, 2 August 2021.

7 https://www.bbc.co.uk/news/world-europe-58141336, 9 August 2021.

8 https://twitter.com/GretaThunberg/ status/1415600846356819971?s=20, 15 July 2021.

9 https://www.ico.org/show_news.asp?id=761

10 https://www.wsj.com/articles/texas-grapples-with-crushingpower- bills-after-freeze-11614095953

11 https://www.iea.org/reports/net-zero-by-2050

12https://www.bbc.co.uk/news/world-europe-57257982

13https://www.reuters.com/business/sustainable-business/ shareholder-activism-reaches-milestone-exxon-board-votenears- end-2021-05-26/

14https://www.reuters.com/business/energy/chevronshareholders- approve-proposal-cut-customeremissions- 2021-05-26/

15Energy & Climate Intelligence Unit, TAKING STOCK: A global assessment of net zero targets, March 2021.

16https://ec.europa.eu/commission/presscorner/detail/en/ ip_21_3541

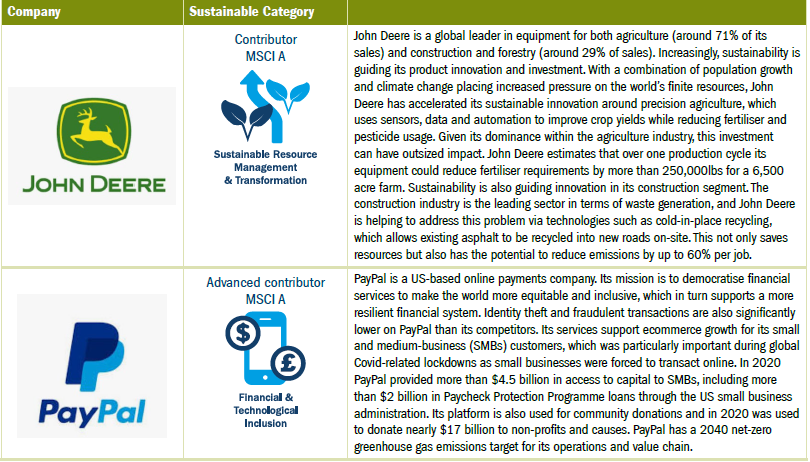

Company Q221 highlights

We have initiated new positions in the strategy:17

17The mention of any specific shares or bonds should not be taken as a recommendation to deal. All intellectual property rights in the brands and logos are reserved by the respective owners.

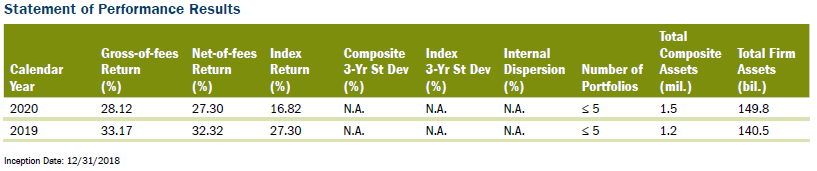

Threadneedle Global Sustainable Equity Composite

GIPS Report: Columbia Threadneedle Investments EMEA APAC

Reporting Currency: USD

1. Columbia Threadneedle Investments EMEA APAC ‘the Firm’

claims compliance with the Global Investment Performance

Standards (GIPS®) and has prepared and presented this report

in compliance with the GIPS Standards. Columbia Threadneedle

Investments EMEA APAC has been independently verified by Ernst

& Young LLP for the periods 1st January 2000 to 31st December

2018. The verification reports are available upon request. A firm

that claims compliance with the GIPS standards must establish

policies and procedures for complying with all the applicable

requirements of the GIPS standards. Verification provides

assurance on whether the firm’s policies and procedures related

to composite and pooled fund maintenance, as well as the

calculation, presentation, and distribution of performance, have

been designed in compliance with the GIPS standards and have

been implemented on a firm-wide basis. Verification does not

provide assurance on the accuracy of any specific performance

report. GIPS® is a registered trademark of CFA Institute. CFA

Institute does not endorse or promote this organization, nor does

it warrant the accuracy or quality of the content contained herein.

2. The ‘Firm’ is defined as all portfolios managed by Columbia

Threadneedle Investments EMEA APAC (prior to 1 January 2021,

the firm was known as Threadneedle Asset Management) which

includes Threadneedle Asset Management Limited, (TAML),

Threadneedle International Limited, (TINTL), Threadneedle

Investments Singapore (Pte.) Limited, (TIS), and Threadneedle

Management Luxembourg S.A. (TMLSA), excluding directly

invested property portfolios. The firm definition was expanded in

2015 to include portfolios managed by then newly established

affiliates of Threadneedle Asset Management in Singapore. TAML

& TINTL are authorised and regulated in the UK by the Financial

Conduct Authority (FCA). TINTL is also registered as an investment

adviser with the U.S. Securities and Exchange Commission and

as a Commodities Trading Advisor with the U.S. Commodity

Futures Trading Commission. TIS is regulated in Singapore by

the Monetary Authority of Singapore. TMLSA is authorised and

regulated in Luxembourg by the Commission de Surveillance du

Secteur Financier (CSSF). On 1 July 2020, Threadneedle Asset

Management Malaysia Sdn. Bhd (TAMM) was removed from the

firm. Columbia Threadneedle Investments is the global brand

name of the Columbia and Threadneedle group of companies.

Beginning 30 March 2015, the Columbia and Threadneedle

group of companies, which includes multiple separate and

distinct GIPS-compliant firms, began using the global offering

brand Columbia Threadneedle Investments.

3. A concentrated global equity strategy with a focus on high

quality companies that seeks to deliver both positive sustainable

outcomes, in accordance with the UN Sustainable Development

Goals (SDGs), and superior financial returns. The composite was

created November 30, 2018.

4. The portfolio returns used in composites are calculated

using daily authorised global close valuations with cash flows

at start of the day. Composite returns are calculated by using

underlying portfolio beginning of period weights and monthly

returns. Periodic returns are geometrically linked to produce

longer period returns. Gross of fee returns are presented before

management and custodian fees but after the deduction of

trading expenses. Returns are gross of withholding tax. Net of

fee returns are calculated by deducting the representative fee

from the monthly gross return. Policies for valuing investments,

calculating performance, and preparing GIPS Reports, as well as

the list of composite descriptions, list of pooled fund descriptions

for limited distribution pooled funds, and the list of broad

distribution pooled funds are available upon request.

5. The dispersion of annual returns is measured by the equal

weighted standard deviation of portfolio returns represented

within the composite for the full year. Dispersion is only shown

in instances where there are six or more portfolios throughout

the entire reporting period. The Standard Deviation will not be

presented unless there is 36 months of monthly return data

available.

6. The three year annualised ex-post standard deviation

measures the variability of the gross-of-fees composite and

benchmark returns over the preceding 36 month period.

7. The following fee schedule represents the current representative

fee schedule for institutional clients seeking investment

management services in the designated strategy: 0.65% per annum. Gross of fee performance information does not reflect

the deduction of management fees. The following statement

demonstrates, with a hypothetical example, the compound effect

fees have on investment return: If a portfolio’s annual rate of

return is 10% for 5 years and the annual management fee is 65

basis points, the gross total 5-year return would be 61.1% and

the 5-year return net of fees would be 55.9%.

8. The MSCI AC World Index is designed to provide a broad

measure of equity-market performance throughout the world

and is comprised of stocks from 23 developed countries and

24 emerging markets. Index returns reflect the reinvestment of

dividends and other earnings and are not covered by the report

of the independent verifiers.

9. Past performance is no guarantee of future results and there is

the possibility of loss of value. There can be no assurance that an

investment objective will be met or that return expectations will

be achieved. Care should be used when comparing these results

to those published by other investment advisers, other investment

vehicles and unmanaged indices due to possible differences in

calculation methods.