We all know obesity is a major health issue. According to the World Health Organisation it affects 650 million people globally and its prevalence is three times what it was in 19751. In the US, the Centers for Disease Control and Prevention (CDC) estimates that 42.4% of adults are obese, up from 30.5% in 1999/20002 – an assessment that was carried out before the onset of the pandemic. The percentage of US adults categorised as severely obese has grown from 4.7% in 2000 to 9.2% in 2017/18. To be severely obese you need a BMI (Body Mass Index) score in excess of 403, meaning for a 5’10” male they would need to weigh more than 278lbs or 126kg. Of even greater concern is the rapid rise in childhood obesity: 19.3% of children between the ages of two and 19 in the US are classified as obese.4 This problem is only going to get bigger.

There is strong evidence linking obesity to the development of various health issues: type 2 diabetes; high blood pressure; cholesterol and coronary heart disease; stroke; metabolic syndrome; diseases of the liver and kidney; and certain cancers.

It is estimated that obesity contributes to one in 13 deaths in Europe.5 With that comes an immense financial burden on society. The World Health Organisation estimates the health bill associated with obesity at $1.2 trillion globally.6 In the US, the CDC puts the cost at $147 billion a year and estimates that the healthcare costs for an obese person are $1,429 higher per year than for a person of healthy weight.7

What can we do about it?

Well, diet and exercise are the time-honoured solutions: eat less, move more. Diets come in many fads: Atkins, Mediterranean, Paleo, 5:2, Keto, Dukan, South Beach … take your pick. Americans buy more than five million diet books every year8, and on attempts to be slim they spend $72 billion a year9 in the diet and health industry. Depressingly, only about 20% of adults sustain their diet-driven weight loss for more than a year.10 It is like the body is fighting you to maintain your weight, to cling on to those excess calories for some future time when they may be in short supply. Weight loss triggers a hormonal response to make you feel hungrier and drives you to consume. Small genetic variations between people can produce significant differences in weight management. Yet despite this medical evidence obesity is a stigmatising condition, associated with above average levels of depression and other psychological issues.

Can science offer hope? Well, two of the companies in which the global equities desk is interested in, Novo Nordisk and Eli Lilly11, believe so. Both have a history in treatments for diabetes and it is one of those treatments that is crossing over to use in obesity. The drugs are GLP-1s which suppress the appetite by mimicking the hormone glucagon-like peptide 1 which is released in the body after eating. This makes people feel full and reduces calorie consumption. Originally designed for use by pre-diabetics to slow progress towards insulin reliance, the potential to tackle the broader obesity problem is now being realised.

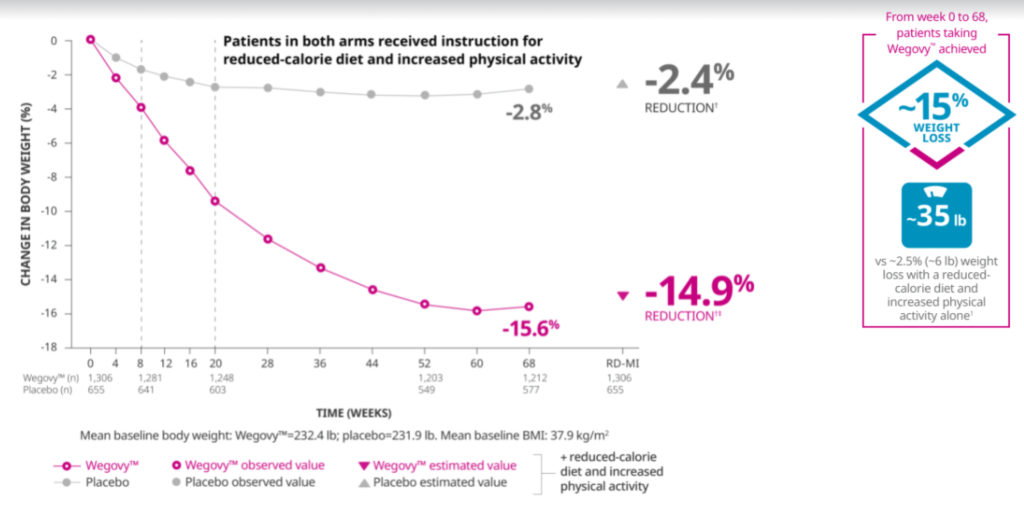

Novo’s drug, Wegovy, is already on the market having proven its efficacy in the STEP 1 trial. Over 68 weeks, patients saw weight loss of 15% or 35lbs (Figure 1). Eli Lilly is set to report on its trial later this year, but it is widely expected the results will be at least as good if not better.

The need for these drugs is clear and we view this as the first of a succession of drugs which will come to market over the next decade or more. Other companies will try to enter the market, but Lilly and Novo have at least a decade head start in research in this area. They also have clear economies of scale in that they already produce these drugs for use in diabetes. This second indication drives volumes in a drug that is tough to manufacture.

Figure 1: increased weight loss from Wegovy use

Source: Novo Nordisk, https://www.novomedlink.com/obesity/products/treatments/wegovy/efficacy-safety/clinical-trial-1-results.html

How big could this market be? Well, there are many factors that go into an assessment – the first of which is simply the number of people. There are nearly 24 million Americans alone with a BMI of 40+ – if each one is treated for one year at the list price of $12 a day that is $105 billion over, say, the next decade. There will be price discounts which will lower that number. However, the National Institute for Health and Care Excellence (NICE), the UK’s notoriously value-for-money-conscious drug regulator, has approved Wegovy 12 for BMI’s over 35 with one weight-related condition, and in certain circumstances to those with a BMI in excess of 30. The US market is four times the size, but someone must pay for it. For health insurers in America to be persuaded, they would need to see the health benefits in terms of improved cardiovascular outcomes and other health benefits. Novo and Lilly have trials planned to demonstrate these benefits.

There is also some evidence that to properly reset the body and stop weight regain the treatment period should be increased to two years, so we would expect evidence to be developed around optimum length of treatment. While Americans pay more for their drugs, a rough rule of thumb would be that the global market should be double that of the US, so the potential numbers are vast and will take the next decade to realise.

What makes us excited is that, in a growing and potentially very large market. Initially the need is being met with an existing diabetes drug, so manufacturing efficiencies are likely to produce improved profit margins. For me, however, there is a difficult question: with a BMI hovering around 30, do I get back on the Keto diet or wait for medical science to ride to the rescue? A 15%-20% weight loss is something many of us aspire to, as that five million diet books sold annually in the US is testament to.